As reported by Anime News Network, Navigating the popularity of anime among international audiences has long been a challenge, especially in the era of streaming. Traditional metrics like “Most Popular” lists on platforms such as Crunchyroll or browsing through Netflix and Hulu’s Top 10 offer limited insights. However, in December of last year, Netflix began sharing more concrete data regarding their titles, shedding light on anime consumption trends for the first half of the year. As someone deeply ingrained in the anime industry, having worked at Crunchyroll, Anime Ltd., and White Box Entertainment, I eagerly seized the opportunity to analyze these numbers for Anime News Network in January. Now, let’s take a deeper dive into the recently-released data covering July through December 2023.

While Netflix’s data represents a significant step forward in understanding the global anime landscape – particularly given its prominence as a leading platform for anime consumption in many countries, including the U.S. – it’s important to recognize its limitations. The aggregated nature of the data makes direct comparisons between titles challenging, and delving into audience demographics or per-episode engagement proves equally complex. Moreover, Netflix’s catalog represents only a fraction of the vast array of new TV anime and films released annually, further narrowing the scope of the data. Therefore, it’s crucial to view this dataset as a snapshot of anime viewership on Netflix rather than a comprehensive view of the anime world at large.

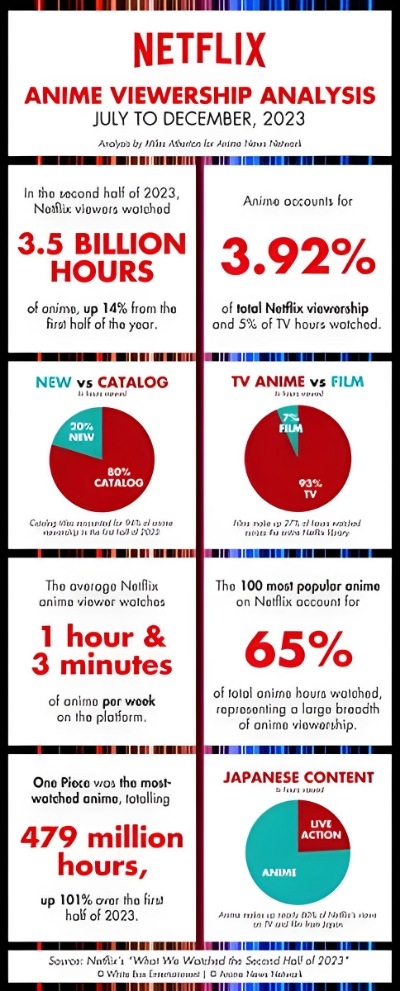

3.5 BILLION HOURS OF ANIME

Anime consumption on Netflix surged during the second half of 2023, totaling 3.5 billion hours and comprising 3.92% of all Netflix viewership. This marks a 14% increase compared to the first half of the year, despite a slight dip in overall engagement on the platform. To contextualize this, the average Netflix anime-watcher consumed an additional 3 hours of anime from July to December, equivalent to three extra weeks of viewership for the typical Netflix anime enthusiast.

This begs the question: Why is anime engagement on the rise during a period where overall Netflix viewership is down? I found four likely answers suggested from the data.

1. The first half of 2023 was an anime drought on Netflix

As you may have noticed in the infographic above, the second half of new releases brought in 20% of anime consumption, compared to 80% for catalog titles. This is nearly identical to the trend on Netflix as a whole, but anime was underwater by this metric from January to June, during which time, new releases accounted for just 6% of all anime hours viewed.

Historically, Netflix has had a somewhat mixed performance in the world of anime, largely owing to their limited exposure. Outside of children’s programming, there are more new Japanese anime a year than animated television programs in the rest of the world combined – more than 200 annually! – but with only a handful of Netflix Originals each year that would qualify under the geographic appellation implied by the word “anime,” it’d be easy for Netflix to have an “off” period. Even in a situation where the Netflix team had clairvoyance as to every anime’s quality ahead of time, the occasional drought is a near guarantee, simply due to the outsized impact a single title failing to connect with an audience can have on such a small slate.

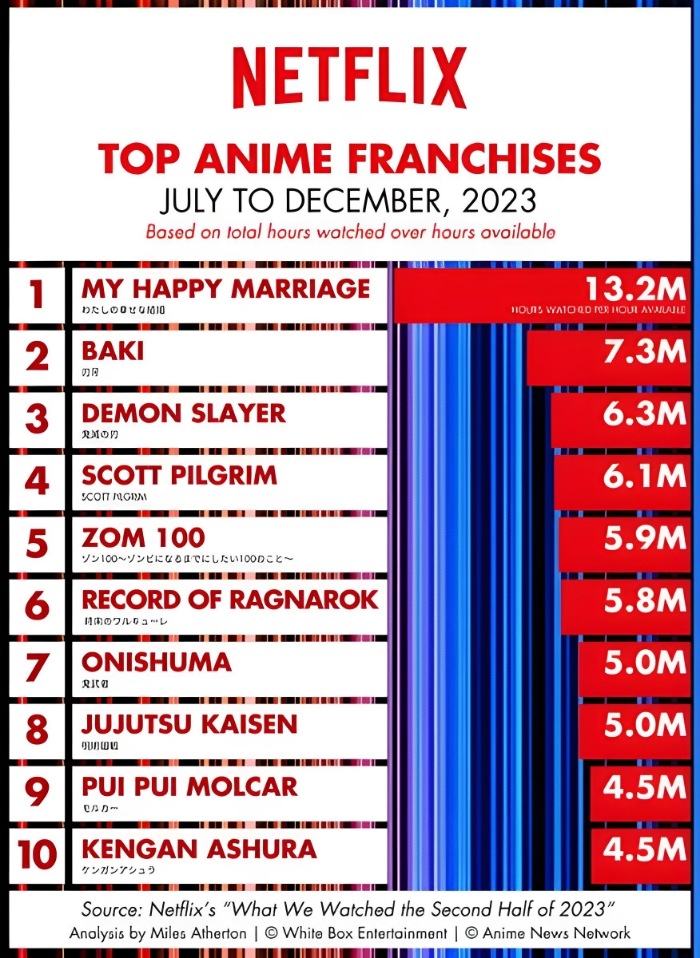

The first half of 2023 witnessed a surge in the production of Netflix Original anime, nearly doubling the offerings compared to previous periods. With larger and more enticing titles hitting the screens, Netflix successfully captured the attention of anime enthusiasts. Utilizing Netflix’s “views” metric, which calculates total hours viewed divided by total hours of content available, it’s evident that the top 10 list of successful IPs predominantly comprised Netflix Original anime. Only Demon Slayer: Kimetsu no Yaiba and Jujutsu Kaisen fell outside of this category.

As we delve further into this analysis, we’ll explore additional factors contributing to the success of specific titles like My Happy Marriage, Baki, and Zom 100: Bucket List of the Dead. Notably, the lineup of original anime for 2023 was concentrated in the latter half of the year. While it’s customary for streaming platforms to maintain a consistent cadence of must-watch releases across demographics, Netflix seemingly operates differently. Despite experiencing a lull in new anime releases for six months, the platform remains relatively unscathed, maintaining its status as the “essential” subscription service. This resilience indicates that Netflix subscribers are poised and eager to engage with compelling new titles whenever they are made available.

2. One Piece Live-Action Fuels Anime Interest

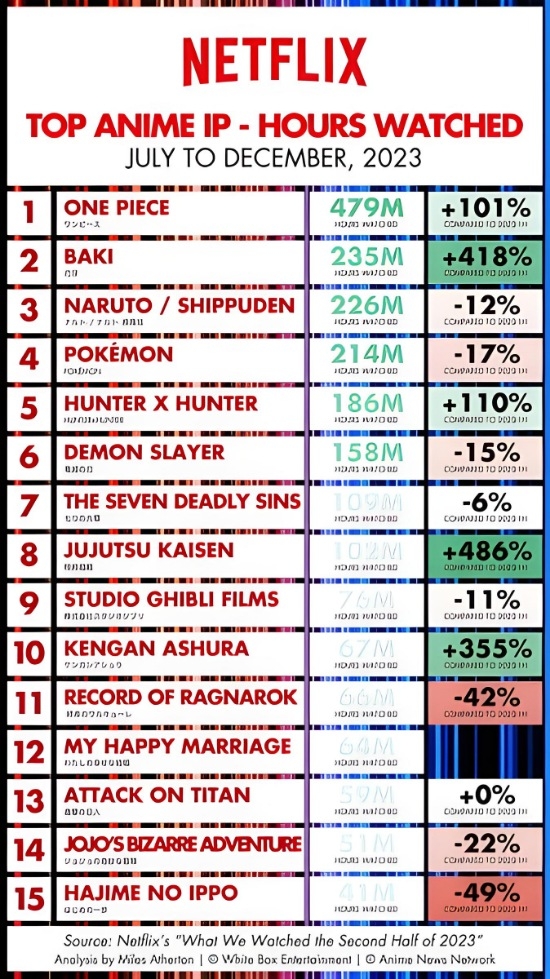

The highly anticipated premiere of the One Piece live-action adaptation during this period sparked significant interest from audiences and critics alike. Leveraging Netflix’s primary metric of success – total hours watched divided by hours of content available – the One Piece live-action swiftly rose to become the platform’s top show in the second half of 2023. Surpassing expectations, it ranked only second to The Night Agent across all of 2023 based on this measurement.

The release of the live-action adaptation also had a profound impact on the One Piece anime franchise. Total hours viewed for the anime more than doubled compared to the first half of the year, a surge unmatched by any other title without a change in availability. Consequently, One Piece surpassed Pokémon and the combined Naruto/Naruto Shippūden in terms of total hours viewed, solidifying its position as the most-consumed anime franchise of the year on Netflix.

In terms of total hours viewed, One Piece surpassed the second-place franchise, Baki, by more than double during this period, despite Baki receiving a new season of content. The data indicates a notable trend: aside from newly-released titles and One Piece, the average anime franchise experienced a decrease in viewership for the second half of 2023, mirroring the behavior observed across the broader Netflix catalog. From my analysis, it’s evident that the strength of the Strawhat crew and an enhanced lineup of new releases were pivotal factors driving anime’s growth on Netflix during this period.

Turning to Hunter x Hunter (2011), its viewership also experienced a significant spike during this period, contrary to the trends seen in franchises as prominent as Pokémon and Naruto. This surge can be attributed to two main factors. Firstly, the title faced the threat of removal from the U.S. and Canada at the end of August. While Netflix successfully renegotiated with North American licensor Viz Media to renew the license, the news of its potential departure likely motivated many fans to engage with the series. Additionally, Nippon TV gradually rolled out additional seasons to over 100 additional territories on Netflix starting in late 2022, culminating in the addition of the “sixth season” of the iconic Shonen Jump series during the second half of 2023. The increased availability of Hunter x Hunter likely played a significant role in its impressive 110% period-over-period growth.

3. Netflix’s anime audience in Asia over-performs

During discussions about the success of the One Piece live-action in an earnings report, Netflix co-CEO Ted Sarandos remarked, “It’s so rare for an English show to be that popular in Japan and Korea, Brazil, and in the U.S. at the same time.”

While One Piece boasts universal appeal, there are specific audiences where it outperforms others. For instance, One Piece ranked lower in the Top 10 of the United States or Canada compared to Latin America and Asia. Similarly, anime exhibits disproportionate popularity in these territories, demonstrating comparable trends on Netflix.

Examining the top 10 anime in finer detail sheds light on this intriguing trend. Within this list, one may notice several titles that might ring a bell for those familiar with them as Crunchyroll exclusives, particularly if they reside outside of Asia. While later seasons of Demon Slayer and Jujutsu Kaisen eventually made their way to Netflix in more regions, during the pivotal period of an anime’s popularity – its simulcast window – these series remained exclusive to a handful of countries. These include Japan, Hong Kong, India, South Korea, Malaysia, the Philippines, Singapore, and Thailand.

Despite representing just an estimated 8.5% of Netflix’s subscriber base – approximately 22 million users as of December 2023 – viewers from these regions watched enough of Demon Slayer and Jujutsu Kaisen to surpass viewer numbers for heavily promoted worldwide exclusives like Scott Pilgrim Takes Off.

Interpreting the total hours viewed over hours available metric (referred to as “views” by Netflix), I tend to view it as a conservative estimate of unique viewership. This interpretation is informed by years of research and 15 years of accumulated piracy data, suggesting that the average anime viewer may not finish an entire series. Therefore, discounting VPN usage, it’s reasonable to infer that at least 7.4 million households in the aforementioned Asian countries watched Jujutsu Kaisen’s second season. In essence, approximately 33% of Netflix subscribers with access to Jujutsu Kaisen Season 2 on the platform engaged with it. To provide context, this viewership rate is comparable to that of major hits like Stranger Things in the United States, based on my estimations.

4. The success of My Happy Marriage should be a blueprint for the future of Netflix’s anime efforts

If you were to take a look at the list of anime that Netflix has branded a “Netflix Original”, you would be forgiven if you were under the impression that anime is a medium aimed squarely at young men.

According to surveys and other research from my anime-focused consulting firm, White Box Entertainment, the Netflix Original anime of the last few years that have performed the best, such as Baki, Record of Ragnarok, KENGAN ASHURA, and The Seven Deadly Sins, are also among the most male-centric anime of the same period. By that, I mean they have incredibly high male-to-female ratios compared to the average series or film.

Popular media (and likely in no small part of the more male-dominated online anime community) perceives anime fans as overwhelmingly male. However, particularly when considering anime as a worldwide phenomenon, it’s hard to find a significant gender gap in terms of the raw number of viewers.

So why hasn’t Netflix dedicated more of its original anime lineup to series and films with female, femme, and non-binary audiences in mind? I speculate that, with how relatively few anime titles Netflix releases each year, they want each one to serve the broadest audience, and have seen data that women of all ages engage with these shonen titles – series obstinately aimed at young men in Japan – at similar rates as their listed target audience.

However, that’s not true for all female anime fans, as seen here with the success of My Happy Marriage. If the weekly Netflix Top 10 lists are any indication, there’s a massive audience across the globe, especially in Latin America and Asia, who are starved for romance anime told from a woman’s point of view.

Titles aimed at female audiences have some interesting trends in the anime arena. They are rewatched more frequently than any other kind of anime, which, for a streaming platform like Netflix, plays a significant role in minimizing churn.

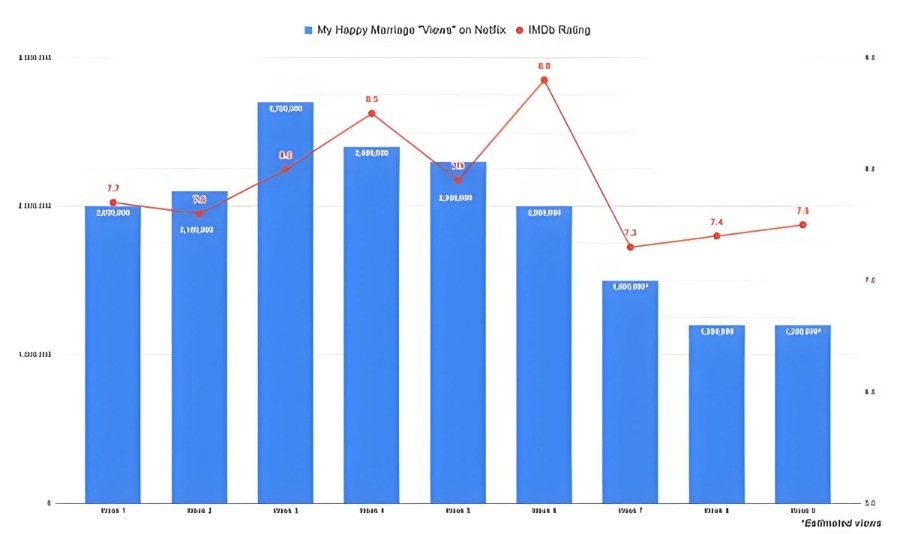

Another compelling reason why I believe My Happy Marriage was so successful was because it was the first anime to be released worldwide on the platform with a simulcast model. While Netflix has done this for talk shows, anime exclusively released in Asia, and a few other shows, typically, the streamer prefers the “binge” model they popularized, where entire seasons are dumped all at once.

While I do not doubt that this release model has its benefits in terms of getting consumers to complete TV shows at a higher rate in addition to other boons only understood by the linear algebra that convinced Netflix to pursue this model, anime fans have been vocal about their displeasure with the binge strategy. For most Netflix Original anime, the domestic broadcast still occurs every week, with international fans doomed to miss the conversation when the series is unceremoniously dropped in full months later. As I’ve discussed at Anime Trending, anime fans are disproportionately loud on social media about their favorite series. Online engagement is deeply entrenched in anime’s culture overseas, where the Internet was the sole means of both access and engagement for most of the anime’s history. With a binge model, Netflix titles were losing the biggest opportunity to wield a superpower unique to anime in most of the world

The success of My Happy Marriage underscores the significance of weekly releases for anime. While many Netflix titles experience a sharp decline in viewership from the first to the second week of release, My Happy Marriage followed the opposite trajectory. Remarkably, it maintained a position on the Top 10 list for non-English TV shows for eight weeks, outlasting Baki Hanma Season 2, despite having fewer overall viewers. Interestingly, Baki Hanma Season 2 attempted to mitigate this decline by splitting its season into two release dates a month apart.

However, this data reveals a slight complication. As illustrated in the chart above, a single “bad” episode, as indicated by IMDb user ratings, can significantly impact a title’s success. My Happy Marriage experienced a drop-off in the weekly Netflix Top 10 lists after a decline in episode ratings, despite initially gaining viewership through word-of-mouth. This highlights Netflix’s reluctance to adopt the weekly release model, as binge-watching could potentially diminish the impact of individual episodes within a longer viewing session.

Delicious in Dungeon, one of my favorite titles of the year, faced similar challenges. Despite releasing new episodes every Thursday, it struggled to maintain viewership above 1 million hours watched per hour of content available each week since its third episode. This performance was notably lower compared to My Happy Marriage and Zom 100 nearly a year ago. Whether Netflix will continue to pursue this release model remains to be seen. However, the substantial online fandom surrounding Delicious in Dungeon suggests its long-term success on the platform, even if viewers opt not to watch it on a week-to-week basis.

Overall, these data signal positive developments for Netflix as a curator of anime content. The remarkable performances of live-action adaptations such as One Piece and Yū Yū Hakusho underscore the immense potential of anime storytelling. Hopefully, the improved performance of anime on the platform will prompt Netflix to increase its production and promotion of emerging series in the coming year. Regardless, I trust that this analysis has shed light on the insights gleaned from the intricate data provided by Netflix, and I look forward to revisiting this discussion in six months’ time!